does nh have food tax

Does nh tax food. 107 - 340 per gallon or 021 - 067 per 750ml.

1800 per 31-gallon barrel or 005 per 12-oz can.

. Please note recently enacted legislation phases out the Interest and. Does nh tax food. The State of New Hampshire does not have an income tax on an individuals reported W-2 wages.

Is food tax exempt in all states. The New Hampshire income tax has one tax bracket with a maximum marginal income tax of 500 as of 2022. Tax policy in New.

However each of these. Does Nh Have Food Tax. This article does not contain the most recently published data on this subject.

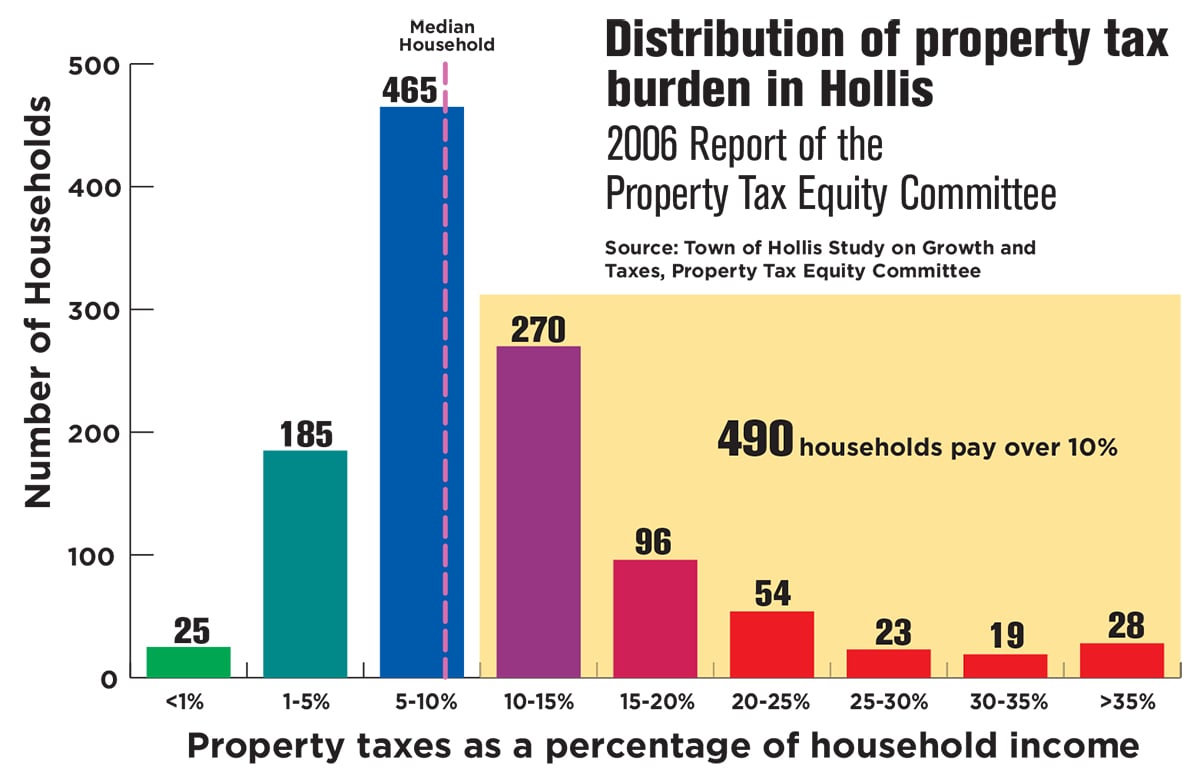

If you need any assistance please contact us at 1-800-870-0285. New Hampshire is one of the five states in the USA that have no state sales tax. While new hampshire lacks a sales tax and personal income tax it does have some of the highest property taxes in the country.

Does Nh Have Food Tax. Delaware Montana Alaska Oregon and New Hampshire do not have state sales tax. Sales and Other Florida State Taxes.

There are however several. There are currently five states that have a 0 sales tax rate. New Hampshire currently taxes investment income and interest.

For all intents and purposes however the Granite State does not have a state. Federal excise tax rates on beer wine and liquor are as follows. The State of New Hampshire does not issue Meals and Rooms Rentals Tax.

Unlike most states New Hampshire does not have a dependent. If you would like to help our coverage grow consider donating to Ballotpedia. Which states do not tax food.

Florida sales taxes apply to several types of purchases. New Hampshire does not have a state sales tax and does not levy local sales taxes. New Hampshire is one of the few states with no statewide sales tax.

This is a flat 5 individual rate. New Hampshires tax system ranks 6th overall on our 2022 State Business Tax Climate. The 2017 maximum benefit permitted for an eligible household of three with no net income is 511 per month which is approximately 549 per person.

At the top end of the scale the state of New York collected 3407 per capita. Does nh have food tax. Florida charges a state sales tax of 6.

The tax should be. Does Florida have food tax. If you have any questions about tax exempt sales please call the Department for clarification at 603 230-5920.

The tax is 625 of the sales price of the meal. The tax should be applied to the sale amount after. Does Nh Have Food Tax.

DOJs first course of action will be to make sure this is a legitimate request. A Alaska Delaware Montana New Hampshire and Oregon do not levy taxes on groceries candy or soda. Accordingly New Hampshire is listed as NA with footnote 11.

State sales tax rate.

Donate The New Hampshire Food Bank

Do Safety Net Programs Impact Food Security In The United States Econofact

Does New Hampshire Love The Property Tax Nh Business Review

Online Menu Of Yanni Pizza Restaurant Hillsborough New Hampshire 03244 Zmenu

Pdf Do Grocery Food Sales Taxes Cause Food Insecurity Semantic Scholar

New Hampshire Sales Tax Rate 2022

New Hampshire Income Tax Calculator Smartasset

New Hampshire Sales Tax Rate 2022

Peterborough Pizza Barn Menu In Peterborough New Hampshire Usa

Sales Taxes In The United States Wikipedia

Five Places In Nh To Get Discounted Food On Tax Day

Hello Tax Reform Goodbye Ballgames Here S What S Changed With Entertainment Deductions Atlanta Business Chronicle

Historical New Hampshire Tax Policy Information Ballotpedia

Cost Of Living In New Hampshire How Does It Stack Up Against The Average Salary

States With The Highest Lowest Tax Rates

Taco Time Cocina Cantina Mexicana Menu In Milford New Hampshire Usa

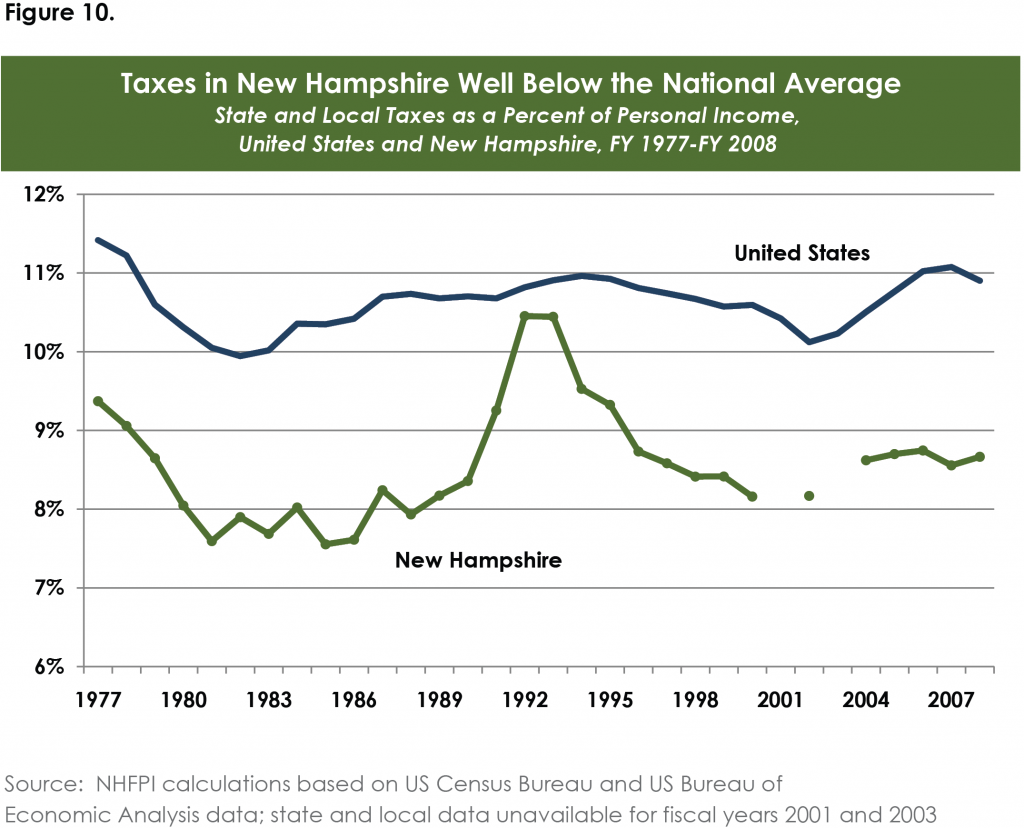

An Overview Of New Hampshire S Tax System New Hampshire Fiscal Policy Institute

New Hampshire Tax Rates Rankings Nh State Taxes Tax Foundation

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)